Introduction to Online Banking

Online banking, often referred to as internet banking, is a technological advancement that enables individuals and businesses to conduct financial transactions via digital platforms. It encompasses services such as account management, money transfers, bill payment, and access to financial information, all conveniently available through computers or mobile devices. In today’s fast-paced digital world, online banking has become a vital aspect of managing finances, providing users with unparalleled convenience and accessibility compared to traditional banking methods.

The evolution of banking services has witnessed a significant shift from physical bank branches to the realm of online transactions. Traditionally, customers would visit their local bank to perform various functions, such as depositing checks, withdrawing cash, or applying for loans. This process was often time-consuming and constrained by banking hours. However, with the advent of the internet and digital technologies, these services have transitioned to online platforms, allowing users to engage with their financial institutions at any time and from any location.

This transformation has been propelled by the increasing adoption of smartphones and high-speed internet, making it possible for customers to manage their finances with a few clicks or taps. Online banking solutions often offer features such as mobile check deposit, online statements, and customizable alerts, further enhancing the user experience and providing greater control over personal finances. The growth of fintech companies has also expanded the variety of options available, offering niche banking services tailored to specific customer needs.

In essence, online banking represents a critical component of modern financial management, promoting efficiency and flexibility for users. As technology continues to advance, the expectations for online banking services will likely evolve, further integrating financial services into the everyday lives of individuals and businesses alike.

How Online Banking Works

Online banking operates on a framework that seamlessly integrates technology with traditional banking practices. At its core, online banking allows users to access and manage their accounts through digital platforms, either via websites or mobile applications. This convenience empowers customers to perform transactions, check balances, and monitor account activity from virtually anywhere and at any time, provided they have internet access.

The process begins with account holders logging into their banking institution’s secure digital platform using their credentials, such as a username and password. Once authenticated, users are presented with a dashboard displaying various account details, enabling them to conduct banking activities with ease. The enhancements in technology facilitate not only basic functions, like fund transfers and payee setup but also advanced services, including budgeting tools and financial planning resources.

An essential aspect of online banking is security. Banks employ robust encryption technologies to protect sensitive information during data transmission. This encryption ensures that any personal and financial data exchanged between the user and the bank remains confidential and secure. Moreover, online banking systems implement various security protocols, such as multi-factor authentication and regular system updates, to enhance protection against cyber threats. These measures help build customer trust, ensuring that users feel confident in accessing their accounts online.

In addition to facilitating basic banking functions, online banking platforms provide a wide array of services tailored to meet customer needs. Users can access features like mobile check deposits, online bill payments, and notifications for account activity, thereby streamlining their financial management. As technology evolves, online banking is expected to continue expanding its offerings, further enhancing the user experience and security in managing financial transactions.

Key Features of Online Banking

Online banking has revolutionized the way individuals and businesses manage their finances. Its essential features are designed to provide convenience, accessibility, and enhanced financial control to users. At the core of online banking is account management, allowing users to view account balances, transaction histories, and monthly statements from the comfort of their own devices. This functionality eliminates the need for physical bank visits and streamlines the banking experience.

Another vital feature of online banking is the ability to transfer funds seamlessly between accounts or to external recipients. Users can initiate same-day transfers, schedule future payments, and even send money internationally in some cases. This convenience extends to bill payments, where customers can set up automatic payments or pay bills on-the-go, ensuring that all financial obligations are met timely without the hassle of writing checks or visiting service providers.

One of the most innovative features offered by online banking services is the mobile check deposit capability. This function allows users to deposit checks using their smartphones, effectively replacing the traditional check deposit process. Users simply take a picture of the check and submit it through their banking app, making checking deposits quick and straightforward.

Additionally, many online banking platforms are equipped with budgeting tools and financial analytics options, which enhance user experience by providing insights into spending habits and financial goals. These features come with customizable settings, enabling users to track expenses and create budgets tailored to their financial situations. By utilizing these tools, individuals can achieve better financial management and make informed decisions about their spending and saving patterns.

Advantages of Online Banking

Online banking has transformed the way consumers manage their finances, providing numerous advantages that cater to the needs of modern lifestyles. One of the primary benefits is the unparalleled convenience it offers. Customers can access their accounts at any time, from anywhere, using their computers or mobile devices. This 24/7 access ensures that banking activities can occur without the constraints of traditional banking hours, allowing individuals to check balances, transfer funds, or pay bills whenever it suits them.

Additionally, online banking typically offers reduced fees compared to brick-and-mortar banks. With lower operational costs, online banks can pass savings on to their customers through fewer charges for maintenance, overdrafts, and other transactions. This reduction in fees can greatly enhance a customer’s financial health, making it easier to manage their budget and attain savings goals.

Another significant advantage of online banking is the ability to perform various transactions seamlessly. This includes the immediate transfer of funds, applying for loans, or even opening new accounts, all from the convenience of one’s home. The integration of advanced technological features also comes with options like bill reminders, spending tracking tools, and budgeting resources, which can lead to smarter banking choices and better financial management.

Moreover, online banking platforms usually prioritize customer security, employing encryption and multi-factor authentication systems to protect sensitive information. This focus on security helps build trust with customers who may have been hesitant to switch from traditional banking methods. As an efficient and secure alternative, online banking stands out as a preferable option for many individuals seeking better control over their financial future.

Disadvantages of Online Banking

While online banking offers a range of advantages, it is essential to acknowledge the potential downsides that accompany this modern financial service. One of the primary concerns is cybersecurity risk. As banks shift more of their operations to digital platforms, the threats posed by hackers and cybercriminals have also escalated. Online banking customers often face the possibility of identity theft, fraudulent transactions, and data breaches. Despite banks employing advanced security technologies, no system is entirely immune to such threats, leaving customers potentially vulnerable.

Another significant drawback is the reliance on technology. Online banking requires access to stable internet service and compatible devices, which may not be readily available to everyone. Technical issues, such as internet outages or server failures, can prevent customers from accessing their accounts when needed, complicating payments and withdrawals. Furthermore, issues with banking apps or websites—such as glitches or unexpected updates—can hinder the user experience, leading to frustration and possible financial setbacks.

The lack of personal interaction is yet another aspect that some clients find unfavorable. Traditional banking allows for face-to-face communication with bankers, which can be crucial for customers needing assistance with complex financial matters or simply wishing to foster a trusting relationship with their bank. The absence of this personalization in online banking can lead to feelings of isolation and diminished customer service satisfaction.

Moreover, while most banks provide support via phone and online chat, response times vary significantly, which can be an issue during urgent situations. Customers may feel disheartened if their concerns are not addressed quickly enough. Considering these challenges, it is important for individuals to weigh the pros and cons of online banking.

Choosing the Right Online Banking Option

In the digital age, selecting the most suitable online banking option is crucial for effectively managing personal finances. With numerous banks and financial institutions offering services, it is essential to consider various factors that align with individual needs and preferences. One of the first aspects to examine is the fee structure. Many online banks offer fee-free checking and savings accounts, while others may impose monthly maintenance fees or transaction charges. Identifying a bank that minimizes fees can significantly enhance the overall value of online banking.

Interest rates also play a vital role in making an informed choice. Online banks often provide higher interest rates on savings accounts compared to traditional brick-and-mortar establishments. It is advisable to compare rates from multiple banks, as a small difference can lead to substantial earnings over time, especially for long-term savings. Additionally, considering the terms associated with these rates, such as minimum balance requirements or tiered interest rates, is essential to ensure transparency and avoid unexpected changes in the future.

Customer service is another critical factor when choosing an online banking option. While online platforms may lack physical branches, many have invested in robust customer support systems. Prospective customers should investigate the availability of support channels, such as live chat, phone support, or social media engagement. Reading reviews and testimonials can provide insight into the banking experience others have had, which can inform decision-making.

Finally, it is essential to evaluate the available features and conveniences that online banks offer. From mobile banking applications to budgeting tools, apps can enhance the efficiency of managing finances. Take the time to explore the functionalities and ensure that the chosen online banking option aligns with personal financial goals. By considering these factors—fees, interest rates, customer service, and features—individuals can make informed choices regarding their online banking services.

Top Online Banking Options in 2023

As online banking continues to evolve, numerous platforms are vying for attention in 2023. These digital banking services offer various features and benefits tailored to meet diverse financial needs. Below, we explore some of the top online banking options, highlighting their key attributes, fee structures, and user feedback.

One prominent option is Ally Bank, known for its competitive interest rates on savings accounts and CDs. Ally’s user-friendly mobile app and online interface make it easy to manage accounts and track spending. They also provide 24/7 customer service, which has consistently garnered positive reviews from clients. Importantly, Ally charges no monthly maintenance fees, making it a budget-friendly choice for consumers.

Another notable contender is Chime, which focuses on providing fee-free banking. Chime offers features such as automatic savings tools and early direct deposit, appealing to younger customers and those looking for straightforward banking without the clutter of excessive charges. User feedback highlights Chime’s responsive customer service and intuitive app, enhancing accessibility for users.

For those seeking robust investment options along with traditional banking services, Charles Schwab Bank provides an integrated experience. Schwab offers a high-yield checking account with no foreign transaction fees and unlimited ATM reimbursements. Its brokerage services allow for seamless management of investments alongside banking, attesting to its multifunctionality, which has been praised by users seeking comprehensive financial services.

Lastly, Marcus by Goldman Sachs offers high-interest savings accounts and no transaction fees, appealing to savers. Customers appreciate its straightforward online savings experience and competitive rates. This option is ideal for individuals prioritizing saving over active spending, reflecting a trend towards online platforms catering to diverse financial strategies.

In summary, the online banking landscape in 2023 features a variety of platforms suited for different financial preferences. By evaluating options like Ally Bank, Chime, Charles Schwab Bank, and Marcus by Goldman Sachs, consumers can identify services that best align with their banking needs.

Security in Online Banking

In the realm of online banking, security is of utmost importance for both financial institutions and customers. As more individuals turn to digital platforms for managing their finances, understanding the measures in place to protect personal and banking information becomes essential. One of the primary strategies for enhancing online banking security is the use of strong passwords. Users should create complex passwords that include a mix of uppercase and lowercase letters, numbers, and special characters. It is also advisable to avoid using easily guessed information such as birthdays or names.

Another critical aspect of online banking security is enabling two-factor authentication (2FA). This additional layer of security requires users to provide a second piece of information, usually a temporary code sent to their mobile device, in addition to their password. This ensures that even if a password is compromised, unauthorized access to accounts remains challenging.

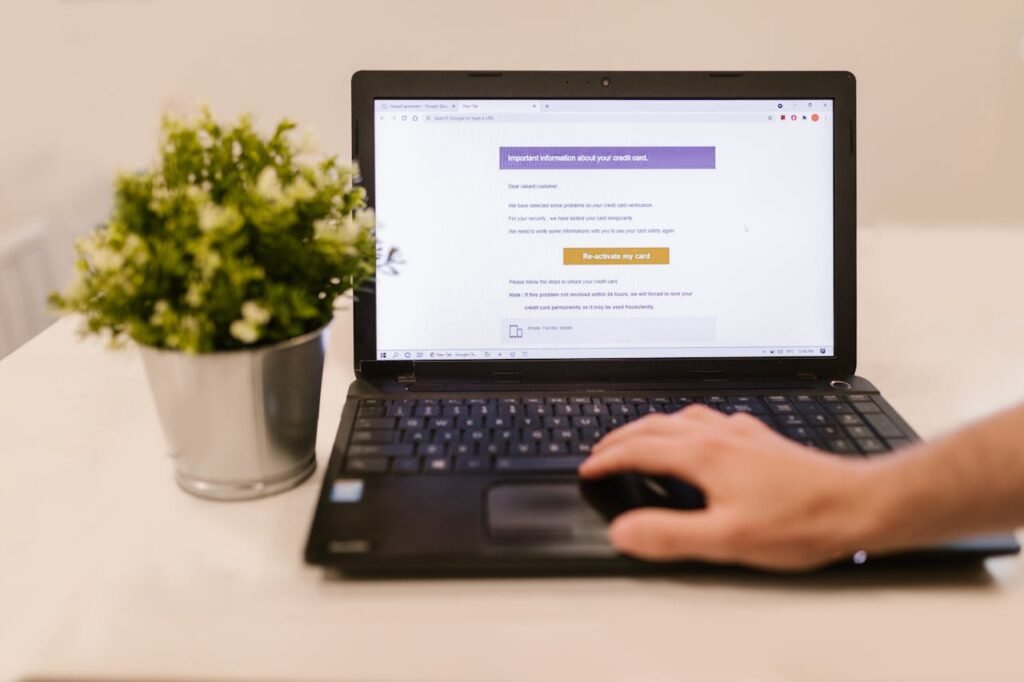

Customers must also remain vigilant against phishing scams, which are attempts to deceive individuals into providing personal information. These scams often come in the form of emails or messages that impersonate legitimate financial institutions. By being cautious and verifying the authenticity of any communication, users can protect themselves from falling victim to these tactics.

Financial institutions take several measures to safeguard user data in online banking. For instance, they implement secure socket layer (SSL) encryption to protect data transmitted between users and their servers, making it difficult for hackers to intercept sensitive information. Additionally, most banks conduct regular security audits and monitor for unusual account activity to detect and respond to potential threats quickly.

In conclusion, understanding security protocols in online banking is crucial for users to protect their financial information effectively. By adopting best practices such as creating strong passwords, enabling two-factor authentication, and being aware of phishing scams, customers can significantly reduce the risk of unauthorized access to their accounts.

Future of Online Banking

The future of online banking is poised for remarkable transformation driven by various technological advancements. As digital banking continues to evolve, innovations such as artificial intelligence (AI), blockchain technology, and the increasing prominence of mobile banking applications are at the forefront of this evolution. These advancements are not only enhancing the convenience of online banking but also redefining the way financial services are delivered and consumed.

Artificial intelligence is playing a pivotal role in reshaping customer experiences in online banking. With AI-driven chatbots and virtual assistants, banks can offer personalized services, faster response times, and improved customer support. Machine learning algorithms are being employed to analyze customer behavior, enabling banks to provide tailored financial advice, predict user needs, and enhance fraud detection mechanisms. This level of personalization fosters greater trust and satisfaction among customers, driving the demand for online banking solutions.

Additionally, blockchain technology is transforming online banking by introducing unprecedented levels of security and transparency. This decentralized ledger system can streamline transactions, reduce operational costs, and enhance the integrity of financial data. As banks explore the potential of smart contracts and cryptographic security, customers may benefit from faster, more secure transactions and a broadening of service offerings within the online banking realm.

Furthermore, the significance of mobile banking applications continues to grow as more individuals utilize smartphones for everyday banking activities. Banks are increasingly investing in user-friendly mobile interfaces with enhanced security features to meet customer needs. These applications are not only facilitating seamless transactions but also incorporating innovative features such as budgeting tools and real-time notifications, thereby improving user engagement.

In light of these trends, the online banking industry stands on the brink of significant change. Embracing technologies like AI and blockchain while prioritizing mobile banking will undoubtedly shape the future landscape of banking, leading to greater efficiency, security, and user satisfaction.

We create powerful, insightful content that fuels the minds of entrepreneurs and business owners, inspiring them to innovate, grow, and succeed.